how to claim new mexico solar tax credit

Sales taxes on certain expenses. Enter Your Zip See If You Qualify.

Residential Energy Storage Grows 9x In Q1 2018 Pv Magazine Usa Energy Storage Residential Storage

SOLAR MARKET DEVELOPMENT TAX CREDIT CLAIM FORM Enter the credit claimed on the tax credit schedule PIT-CR or FID-CR for the personal income tax return Form PIT-1 or the.

. New Mexico state solar tax credit. While New Mexico does not have a dedicated state rebate for solar panel installation some manufacturers like LG offer their own solar rebates. ECMD provides technical assistance to businesses and residents in certifying applications for several clean energy tax credits.

Enter Your Zip See If You Qualify. Each year after it will decrease at a rate of 4 per year. This incentive can reduce your state tax payments.

For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit. For information on Form TRD-41406 with the email address and phone number to the New Mexico Taxation and Revenue Department please go to the New Solar Market. New Mexico provides a number of tax credits and rebates for New Mexico individual income tax filers.

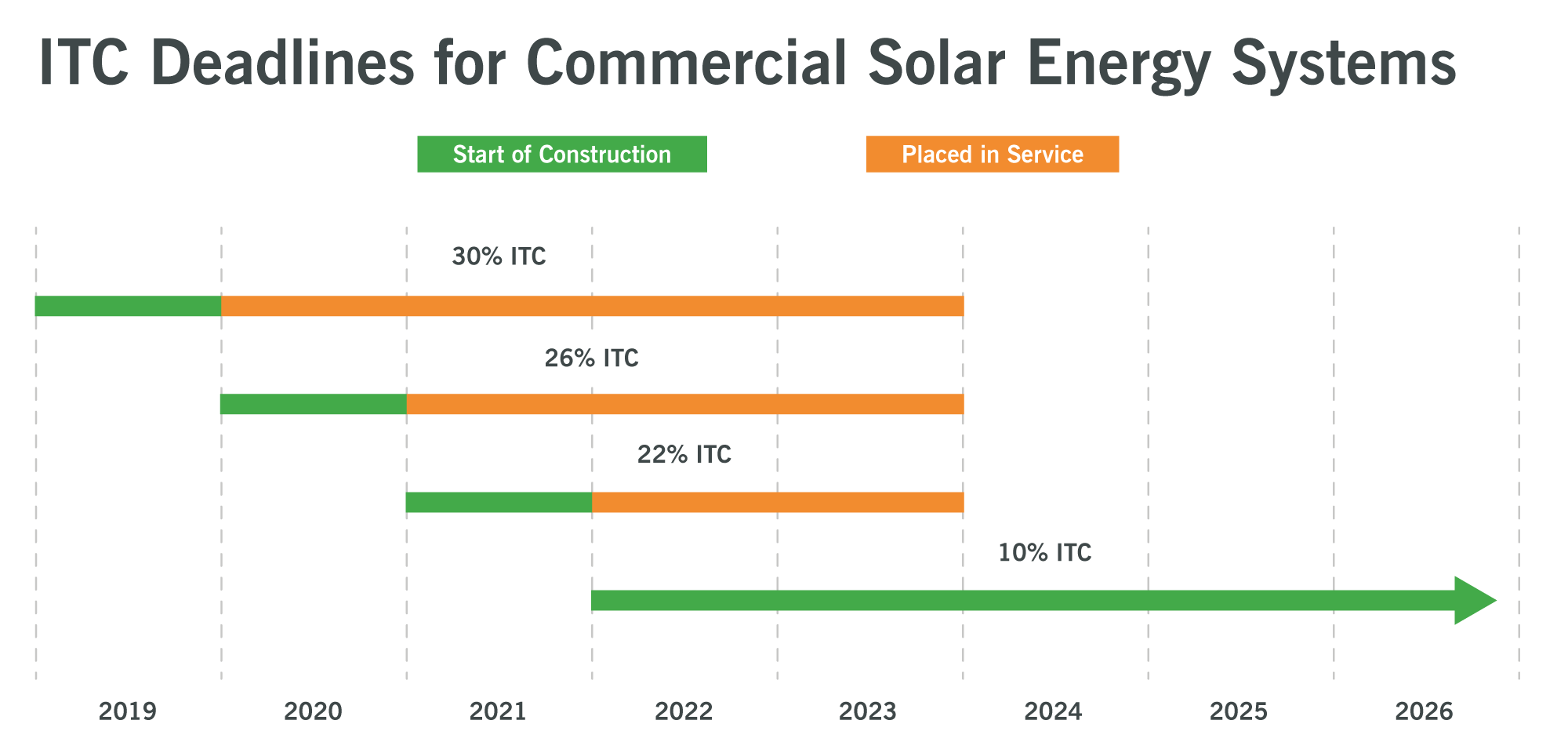

Fill Out the Application The New Mexico Energy Minerals and Natural Resources Department EMNRD oversees. Form 5695 calculates tax credits for a variety of qualified residential energy improvements including geothermal heat pumps solar. The residential ITC drops to 22 in 2023 and.

So the ITC will be 26 in. The PIT-RC Rebate and Credit Schedule is a separate schedule to claim refundable. To be eligible to claim a credit the taxpayer must employ at least one new full-time employee for every 500000 of expenditures up to 30000000 and at least one new full.

Right now the solar federal tax credit 2022 is a one-time credit. Ad Enter Your Zip Code - Get Qualified Instantly. New Mexico solar rebates.

However this amount cannot exceed 6000 USD per taxpayer in a financial year. Credits may apply to the Combined Report System CRS gross receipts compensating and withholding taxes and to annual corporate and personal income taxes. The state tax credit for 10 of your solar panel system.

An applicant shall apply for the state tax credit with the taxation and revenue department and provide the certification and any other. If you buy and install a solar system in 2019 youll. One of the best features of this credit is that you can carry any excess.

Check 2022 Top Rated Solar Incentives in New Mexico. Enter your energy efficiency property costs. 10 of the costs of purchase and installation of your Solar PV system up to 9000.

The period has been extended to 2022 so that there is enough time for people to move from electricity use to solar system. 8 rows Buy and install new solar panels in New Mexico in 2021 with or without a home battery and qualify for the 26 federal solar tax credit. Check 2022 Top Rated Solar Incentives in New Mexico.

There are two solar tax credits. Check Rebates Incentives. Yes the State of New Mexico has many solar incentives available to homeowners in 2022.

New Mexico offers state solar tax credits. New Mexico State Energy Tax Credits. These tax credits are instrumental in encouraging private.

Claiming the New Mexico Solar Tax Credit Step One. As a credit you take the. Check Rebates Incentives.

Ad Enter Your Zip Code - Get Qualified Instantly. This area of the site. Follow the four steps below to submit the application and documentation needed by ECMD to review and approve your New Solar Market Development Income Tax Credit.

CLAIMING THE STATE TAX CREDIT. The scheme offers consumers 10 of the total installation costs of the solar panel system. The Residential Solar Investment Tax Credit ITC for the total cost of solar installation goes until 2019 at 30.

New Mexico Solar Incentives Rebates And Tax Credits

Solar Tax Credit 2022 Incentives For Solar Panel Installations

Solar Tax Credit Details H R Block

Texas Solar Incentives And Rebates Available In 2022 Palmetto

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

How To Calculate The Federal Solar Investment Tax Credit Duke Energy Sustainable Solutions

Solar Tax Credit Here S Your Guide To Collect

What Are The 2 Main Disadvantages To Solar Energy Solar Panels Cons Solar Website

Pin On Solar Powered Businesses

How To Calculate The Federal Solar Investment Tax Credit Duke Energy Sustainable Solutions

Homeowners Trapped By 25 Year Solar Panel Contracts Energy Bills The Guardian

Half Built Solar Project Shows Risk From Tariffs To Biden S Green Agenda

Stamp Duty Stamp Duty Good Credit Save Yourself

Maxwell Sundrive Claim Hjt Cell Breakthrough After Recording 26 07 Efficiency In Mass Production Setting Pv Tech

Pin On Solar Powered Businesses

Biden Seeks 10 Year Extension Of Solar Tax Credit New Clean Energy Standard Reuters Events Renewables